nc sales tax on non food items

In general tax fraud falls into three categories. Before sharing sensitive information make sure youre on a federal government site.

States Can Thoughtfully Implement Grocery Tax Reforms To Help Families And Improve Equity Center On Budget And Policy Priorities

Laundries Apparel and Linen Rental Businesses and Other Similar Businesses.

. Some states charge a lesser sales tax on food items as of 2022 including. Wilmington NC community events for sale gigs housing jobs resumes services all adminoffice business customer service education engineering etcetera finance foodbevhosp general labor government healthcare human resource legal manufacturing marketing media nonprofit real estate retailwholesale sales salonspafitness science security. Prescription Drugs are exempt from the North Carolina sales tax.

Box 449 Fayetteville NC 28302-0449. Favorite this post Aug 24 Accounts Receivable Clerk Alpharetta hide this posting restore restore this posting. The food and beverage.

The Internal Revenue Service has jurisdiction over individual and business income taxes. If a business is planning to have sales a Sales Use Tax number NC-BR is required. Federal state and county.

Maurice Braswell Courthouse 117 Dick Street Fayetteville NC 28301. Food Non-Qualifying Food and Prepaid Meal Plans. Food Non-Qualifying Food and Prepaid Meal Plans.

North Carolina has 1012 special sales tax jurisdictions with local sales taxes in. No masks new rules. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69.

The housing market may be slowing down but rent keeps rising. Does not charge local sales taxes. Who Should Register for Sales and Use Tax.

If you do not have your tax bill payment coupon you can locate and print a copy online at Search Tax Bills and mail it to. Only five states dont impose a sales tax but many exempt food drugs and even clothing to make up for it. Sales and Use Tax.

We have placed a new secure outdoor drop box beside the mailboxes in the Judge E. Thank you for making Chowhound a vibrant and passionate community of food trailblazers for 25 years. Sales and Use Tax Bulletins - See Boats and Related Items Bulletin.

The following items should be included. Payment of sales tax to the state is the responsibility of the business authorized to collect it. If you are starting a non-home based commercial food processing facility for high risk or low risk foods.

This makes it easier for businesses to charge collect and remit taxes. Businesses having employees are required to obtain a Federal. Maurice Braswell Cumberland County Courthouse back parking lot off Cool Spring and Russell Streets.

Lease or Rental of Tangible Personal Property. A handful of states also exempt non-prescription drugs from sales taxes. The type of fraud will determine where you report it.

No mappable items found. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 75. There are several types of tax numbers.

For example if you suspect income tax fraud it wont help if you report it to the sales tax authority. Cumberland County Tax Collector PO. Federal government websites often end in gov or mil.

Winston-salem NC wsl show 51 more. Sales tax generally applies to purchases made within the states borders including merchandise such as motor vehicles. Cumberland County Government Judge E.

Some items like non-prepared food items prescription drugs machinery and equipment are exempt from sales tax in DC. We wish you all the best on your future culinary endeavors. Tax Administration has added another contactless option for making check or money order tax payments and for submitting tax listings and forms.

State of COVID-19 protocols headed into the new school year. Taxes may be paid by Electronic Check draft. The gov means its official.

According to Statistics Canada the food and beverage sector comprises establishments primarily engaged in preparing meals snacks and beverages to customer order for immediate consumption on and off the premises Government of Canada 2012This sector is commonly known to tourism professionals by its initials as FB. 5 On Your Side. Prescription drugs are subject to a 1 sales tax in Illinois.

Use tax applies to items purchased outside the state of California such as by mail order or online where purchasers dont pay. Overview of Sales and Use Taxes. Internship non-profit telecommute employment type.

Find the latest business news on Wall Street jobs and the economy the housing market personal finance and money investments and much more on ABC News. We would like to show you a description here but the site wont allow us. Please make out your check or money order payable to Cumberland County Tax Collector.

A representative agent salesperson or solicitor to help make retail sales in Washington DC. Individual income tax refund inquiries.

How To Pay Sales Tax For Small Business 6 Step Guide Chart

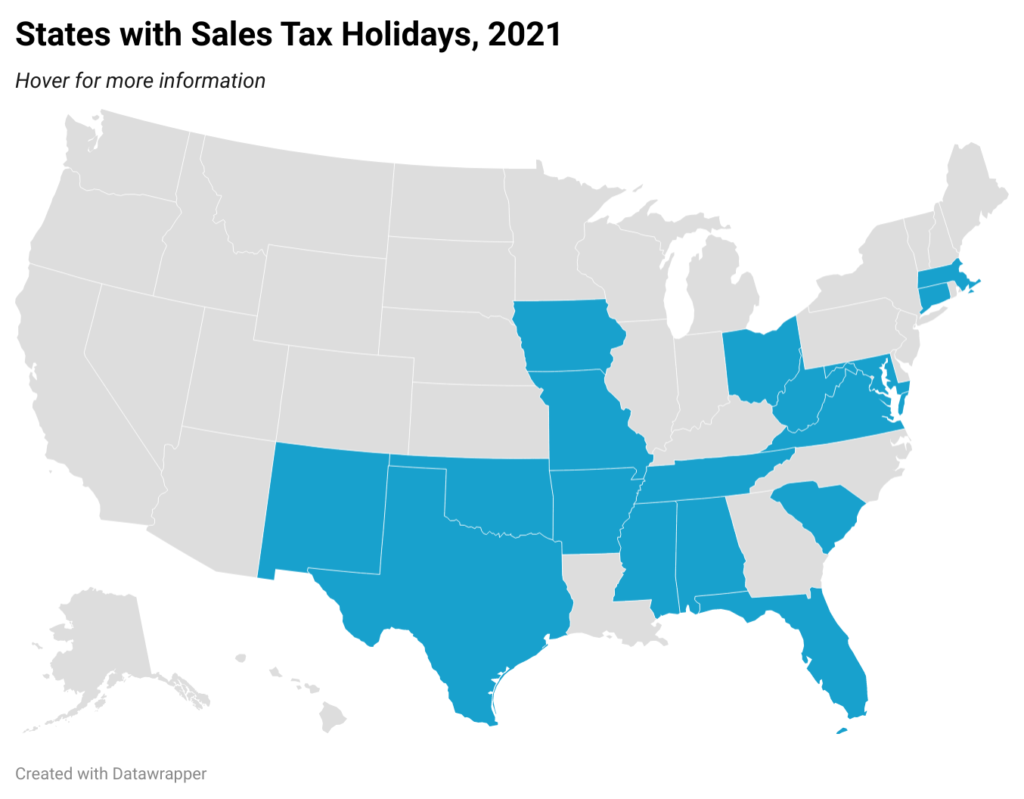

Sales Tax Holidays An Ineffective Alternative To Real Sales Tax Reform Itep

Is Shipping Taxable In North Carolina Taxjar

Sales Tax On Grocery Items Taxjar

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Pennsylvania Sales Tax Small Business Guide Truic

64 Dollar Grocery Budget Harris Teeter

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Tampon Tax Tampon Tax Pink Tax Tampons

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

2020 Sales Tax Holiday Plastic Drop Cloth Hurricane Supplies Disaster Prep

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

What Is Sales Tax A Complete Guide Taxjar

Is Food Taxable In North Carolina Taxjar

Is Food Taxable In North Carolina Taxjar

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation